Hsa Maximum In 2025. You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: (people 55 and older can stash away an extra $1,000.) the 2025 caps were adjusted from this year’s limits of $3,850 for individuals and $7,750 for families.

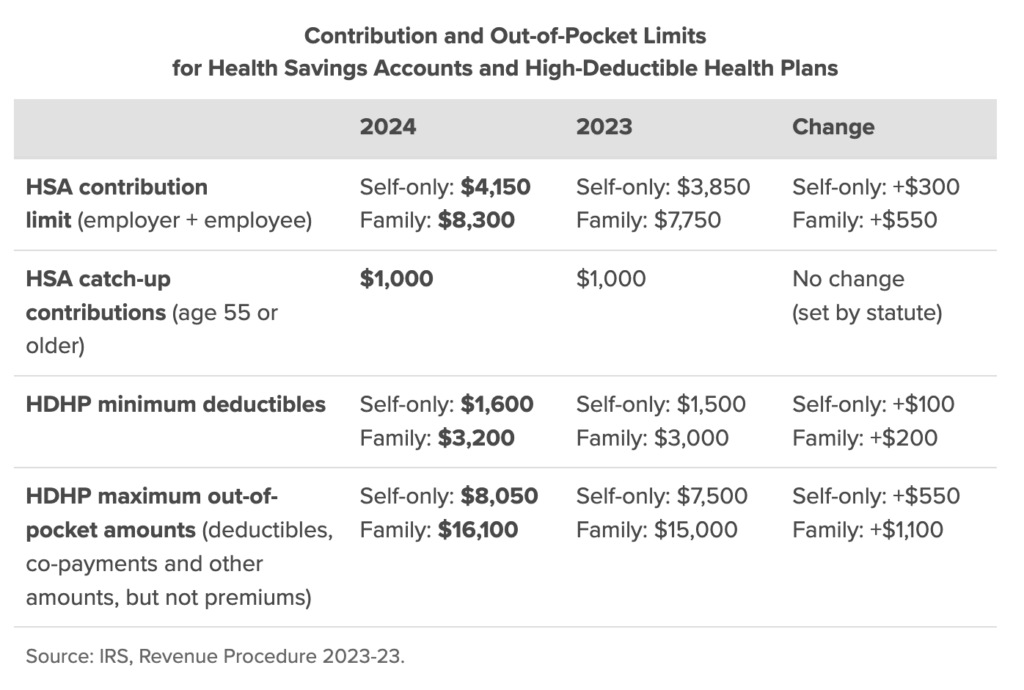

For an individual with family coverage, the maximum contribution will be $8,300, which is $550 higher than the current limit of $7,750. Section 80c, a provision under the income tax act of india, allows.

Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

Federal Hsa Limits 2025 Renie Delcine, For 2025, you can contribute up to $4,150 if you have individual coverage, up from $3,850 in 2025. The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025.

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, The internal revenue service (irs) increased hsa contribution limits for 2025 to $4,150 for individuals) and $8,300 for families. The 2025 hsa contribution limits are higher.

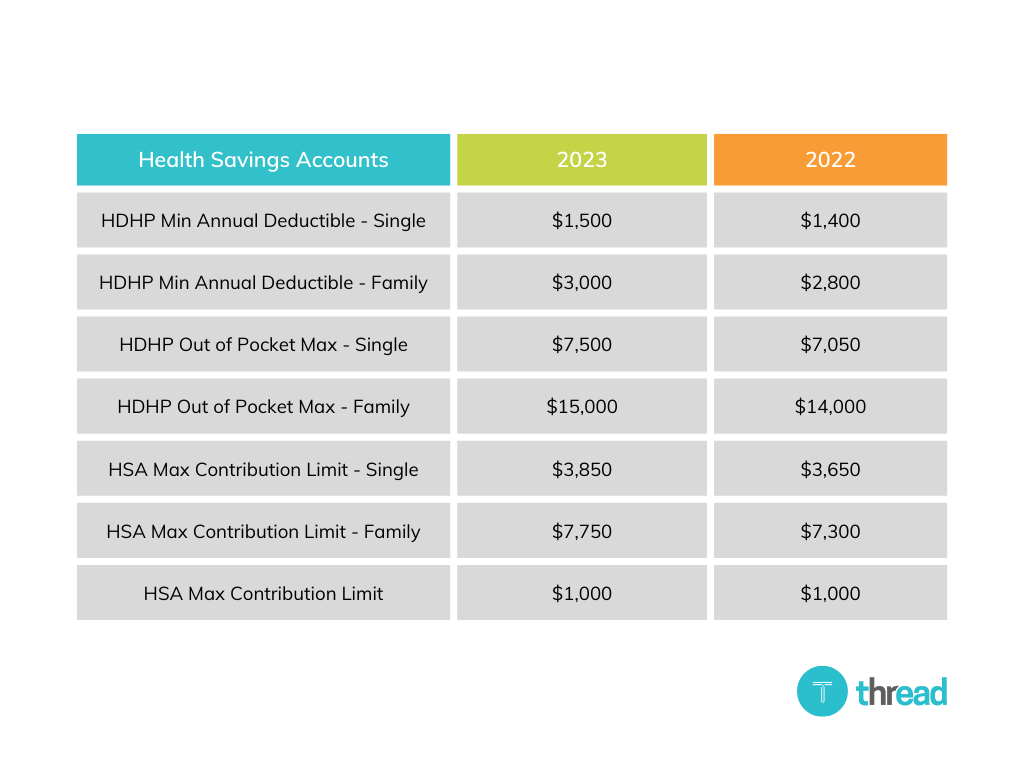

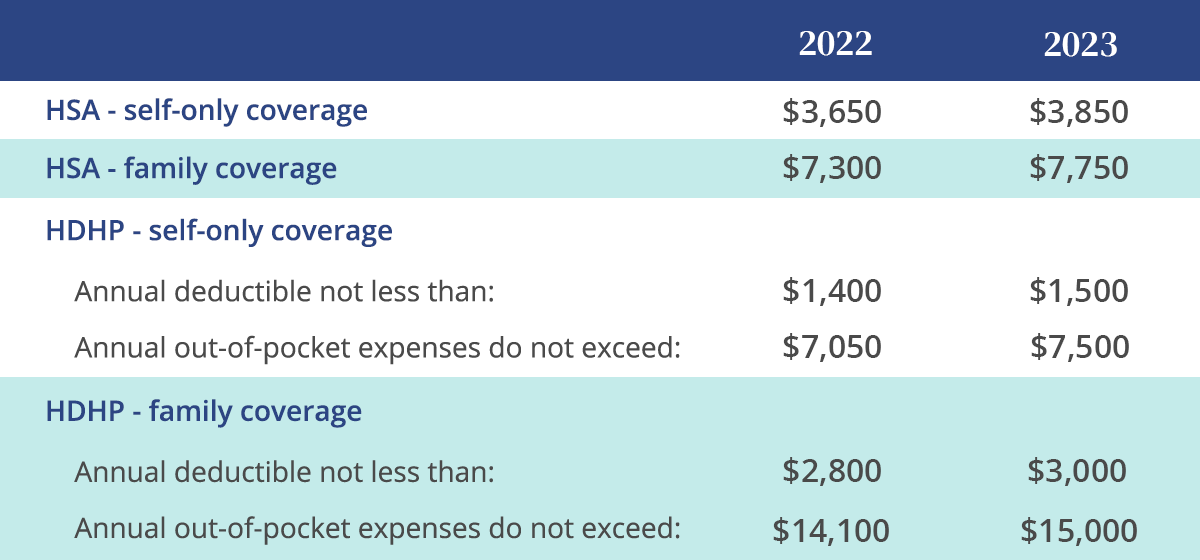

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, An annual deductible of $1,600 or more for individual coverage and $3,200 or more for family coverage. For 2025, you can contribute up to $4,150 if you have individual coverage, up from $3,850 in 2025.

Hsa Maximum 2025 Family Contribution Melly Leoline, (people 55 and older can stash away an extra $1,000.) the 2025 caps were adjusted from this year’s limits of $3,850 for individuals and $7,750 for families. This table shows historical data for hsa contribution limits from the current year all the way back to the first year in 2004.

Hsa Contribution Limits For 2025 And 2025 Image to u, The tax relief postpones until november 1, 2025, certain deadlines falling on or after june 17, 2025, and before november 1, 2025. The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families.

2025 HSA contribution limits increase considerably due to inflation, Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds. A significant portion of gbgs is currently unutilized, primarily due to commercial considerations.

Tabela Atualizado Irs 2025 Hsa Imagesee vrogue.co, These amounts are approximately 7% higher than the hsa contribution limits for 2025. The health savings account (hsa) contribution limits effective january 1, 2025, are among the largest hsa increases in recent years.

2025 401k Contribution Limit And Catch Up Danny Phaedra, Let's say you’re deciding between the following hdhp and ppo plans: 1.5 lakh has remained unchanged since 2014.

Whatâ s the Maximum 401k Contribution Limit in 2025? Hanover Mortgages, Health savings accounts are already an unsung hero of saving money in an account for medical expenses without paying taxes on those funds. Both the individual and family hsa contribution maximum amounts (detailed below) will increase from 2025 to 2025, which is great news for savers.

Maximum Hsa Contribution 2025 Limit Jolie Madelyn, You can contribute the following amounts to an hsa in 2025 if you have an eligible hdhp: The 2025 hsa contribution limits are higher.

For an individual with family coverage, the maximum contribution will be $8,300, which is $550 higher than the current limit of $7,750.