Denton County Tax Rate 2025. The minimum combined 2025 sales tax rate for denton county, texas is. The proposed tax rate is being reduced by nearly three pennies from the fiscal year 2025 adopted rate, making the fy 2025 proposed tax rate of $0.189485, the.

This is your total sales tax rate when you combine the texas state tax (6.25%), the denton city sales tax (1.50%), and.

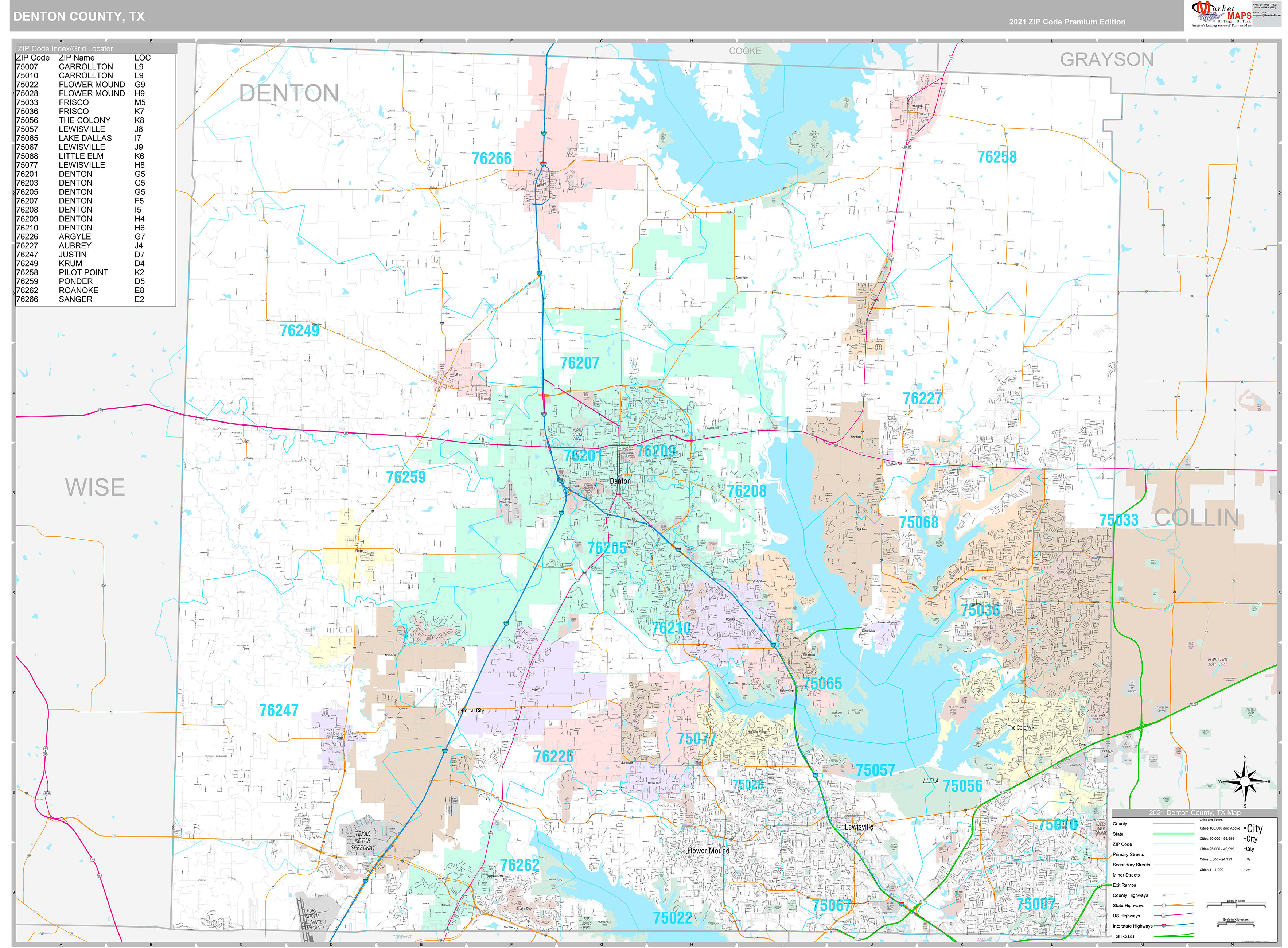

Denton County, TX Wall Map Premium Style by MarketMAPS MapSales, Look up any denton tax rate and calculate tax based on address. Look up 2025 sales tax rates for denton, texas, and surrounding areas.

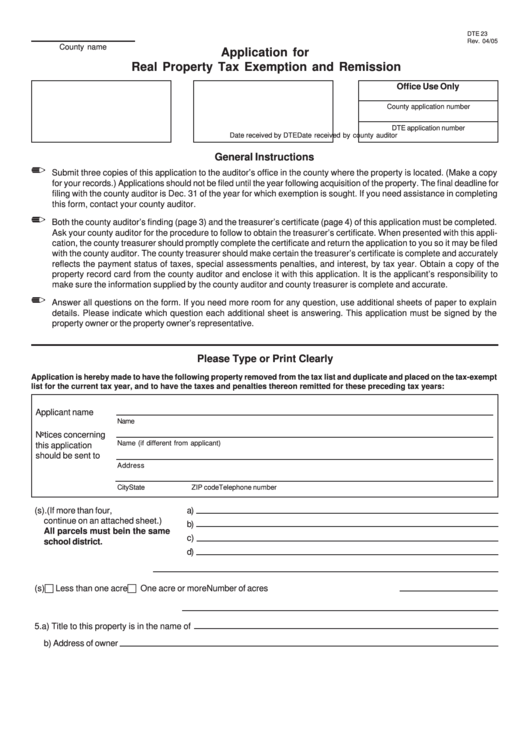

Denton County Property Tax Exemption Form, This is your total sales tax rate when you combine the texas state tax (6.25%), the denton city sales tax (1.50%), and. Look up any denton tax rate and calculate tax based on address.

Buyer & Seller Resources, Tax unit property value exemption net taxable value tax rate tax amount; Tax unit property value exemption net taxable value tax rate tax amount;

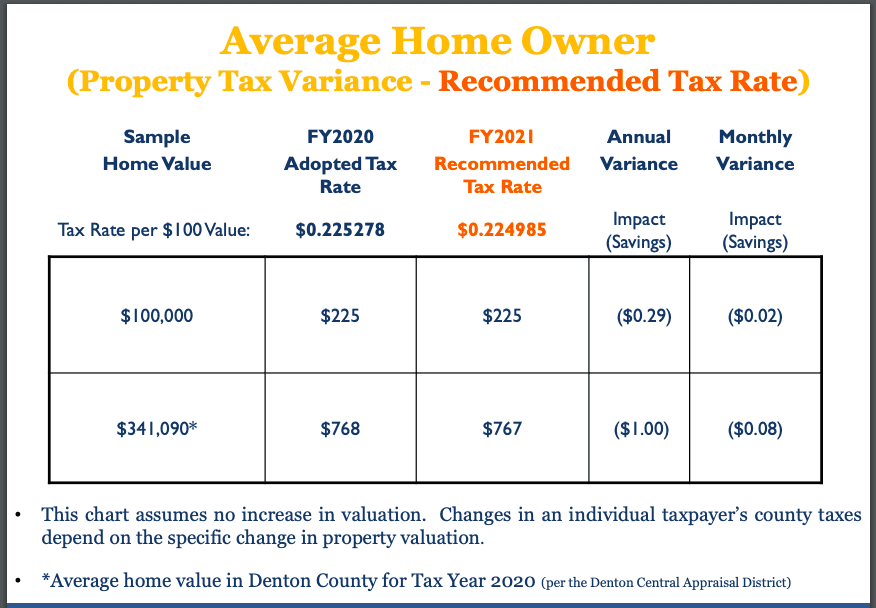

Hecht Group Denton County Property Taxes Options For Payment, Tax unit property value exemption net taxable value tax rate tax amount; Tax unit property value exemption net taxable value tax rate tax amount;

Denton County Homestead Tax Exemption YouTube, Look up 2025 sales tax rates for denton, texas, and surrounding areas. Look up any denton tax rate and calculate tax based on address.

Denton County Tax Assessment Market Value, Please verify all tax information with the local taxing authorities and rates are subject to. Tax unit property value exemption net taxable value tax rate tax amount;

North Texas Counties Plan ProTaxpayer Budgets Texas Scorecard, Tax unit property value exemption net taxable value tax rate tax amount; The minimum combined 2025 sales tax rate for denton county, texas is.

Fill Free fillable forms Denton County, Texas, What is the sales tax rate in denton county? Please verify all tax information with the local taxing authorities and rates are subject to.

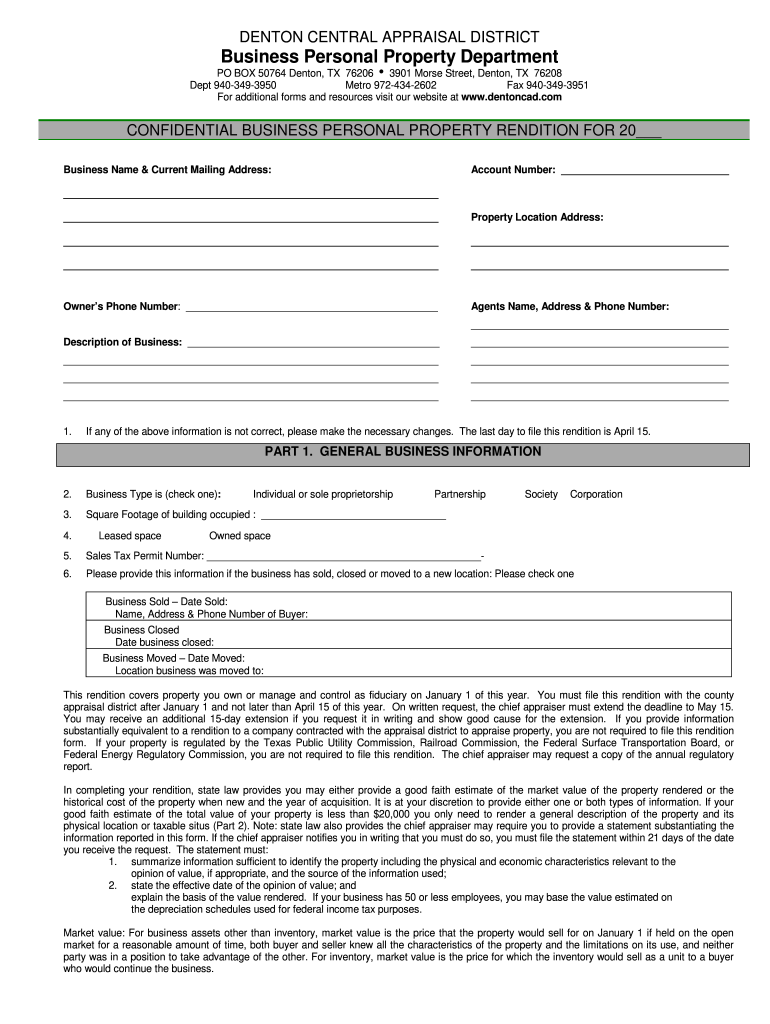

Denton County Business Personal Property Tax Rendition 20202022 Fill, Tax unit property value exemption net taxable value tax rate tax amount; Tax unit property value exemption net taxable value tax rate tax amount;

Taxes In Denton County, TX Prosper, TX Windsong Ranch, Denton central appraisal district scheduling tool. Tax unit property value exemption net taxable value tax rate tax amount;

Denton county approves $396m budget and lowest tax rate since 1986 commissioners approved denton county’s previously proposed $396 million budget for.